|

|||||||||||||||

| The Ric Young Show -- Interview with Ronnie Moas (30 minutes) | |||||||||||||||

| Move by a top stock market advisor is causing shockwaves on Wall Street | |||||||||||||||

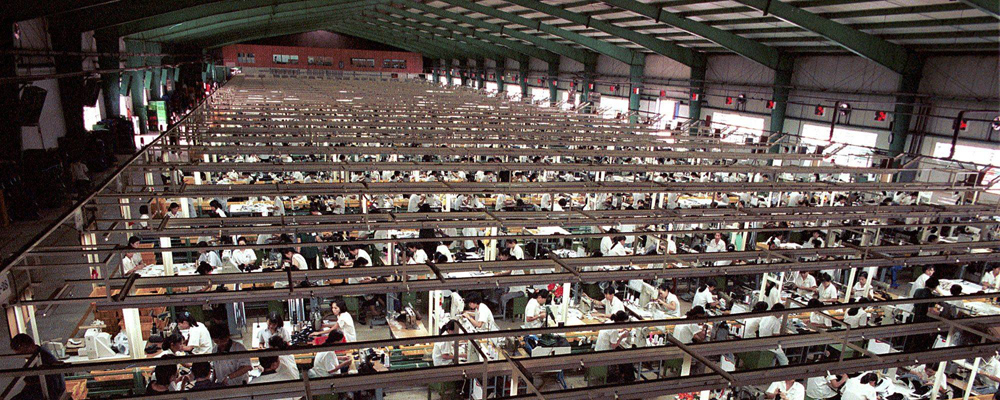

| Ronnie Moas is the Founder of Philanthropy and Philosophy, and Director of Research and Founder at Standpoint Research. The company currently advises and sells its research to pension funds, hedge funds, day-traders and asset management firms. Moas wrote a 44-page report blasting the labor practices of Apple, Amazon and the deadly impact of cigarettes produced by Philip Morris. Moas says he is fed up with the greed exhibited by Apple, which he says is sitting on 150 billion dollars and only pays its Chinese workers several dollars an hour. Host Ric Young talked with Moas in a three-part interview about why he believes it's time for Wall Street and corporate America to change its focus away from making trillions on the misery working people. | |||||||||||||||

| http://voiceofrussia.com/us/2014_01_09/All-blacklisted-for-ethical-violations-Apple-Amazon-and-Philip-Morris-5868 | |||||||||||||||

| The Tim Danahey Show -- Interview with Ronnie Moas (50 minutes) | |||||||||||||||

| We vote at the ballot box and where we shop. Now consider voting where you invest. Ronnie Moas founded Standpoint Research and became one of the top investment advisors in the world. He created shockwaves and a global sensation when he advised his clients to divest themselves of Apple, Amazon, Philip Morris, and Yahoo for moral and ethical reasons. Listen to him explain how he believes the extremes of wealth and poverty are not sustainable and should not be allowed to continue. His conscience will not allow him to remain silent while billionaires are making their money off employees that are exploited, abused, and suffering. He has grown weary of extreme greed and the excesses of capitalism. It is now time to put the world's excess wealth to work helping the poor, starving, and disadvantaged. If we can invest, it is time we consider the ethical consequences of what our investments enable. Also, he walks the talk and created a global charity. It can be done successfully. Listen to Ronnie Moas and find out why we must do it now. | |||||||||||||||

| http://danahey.com/ethical-investing-why-we-must-do-it-now | |||||||||||||||

|

Ronnie Moas « Quelqu'un à Wall Street devait parler des conséquences du capitalisme » (someone needs to speak out against extreme forms of capitalism)

|

|||||||||||||||

|

Translation of the transcript of Ronnie Moas interview with Julien Cadot, Editor in Chief, RAGEMAG (France)

Since the publication of his 44-page report on ethics and morality in finance, Wall Street analyst, and Philanthropy & Philosophy Founder, Ronnie Moas received widespread attention in the world media. By blacklisting six major American companies, on ethical and moral grounds, Moas distanced himself from most in the financial services industry.

|

|||||||||||||||

| What is the activity of Standpoint Research, the firm that you created in 2004? | |||||||||||||||

Standpoint Research is an independent research provider with no conflicts of interest.

Standpoint Research is an independent research provider with no conflicts of interest. We give stock recommendations mainly to hedge funds and mutual funds. I also have some individual customers. Ideas are generated by a 155-variable computer model that I developed (1998-2003) over a period of five years. I run the model weekly and it generates ideas for me. I then apply fundamental and subjective overlays before issuing an actual recommendation – that goes out in the form of a 15-20 page report. I don't just recommend a name because it scores well on my computer model. During the last six years, I have issued more than 400 (audited) recommendations, and there is no Wall Street firm that was as accurate -- 69% of my recommendations beat the S&P-500 by at least 500 basis points (five percentage points). |

|||||||||||||||

| CLICK HERE for the entire nine-page transcript/interview | |||||||||||||||